Despite the challenging global macroeconomic environment, 2022 was an incredibly successful year for EFG Hermes’ sell-side business.

Sell-side overview

Despite the challenging global macroeconomic environment, 2022 was an incredibly successful year for EFG Hermes’ sell-side business. Despite rising inflationary pressures and interest rates, currency devaluations, and political instability, I am happy to say that each division under the sell-side umbrella came out strong, rising above the hurdles and delivering exceptional operational and financial results.

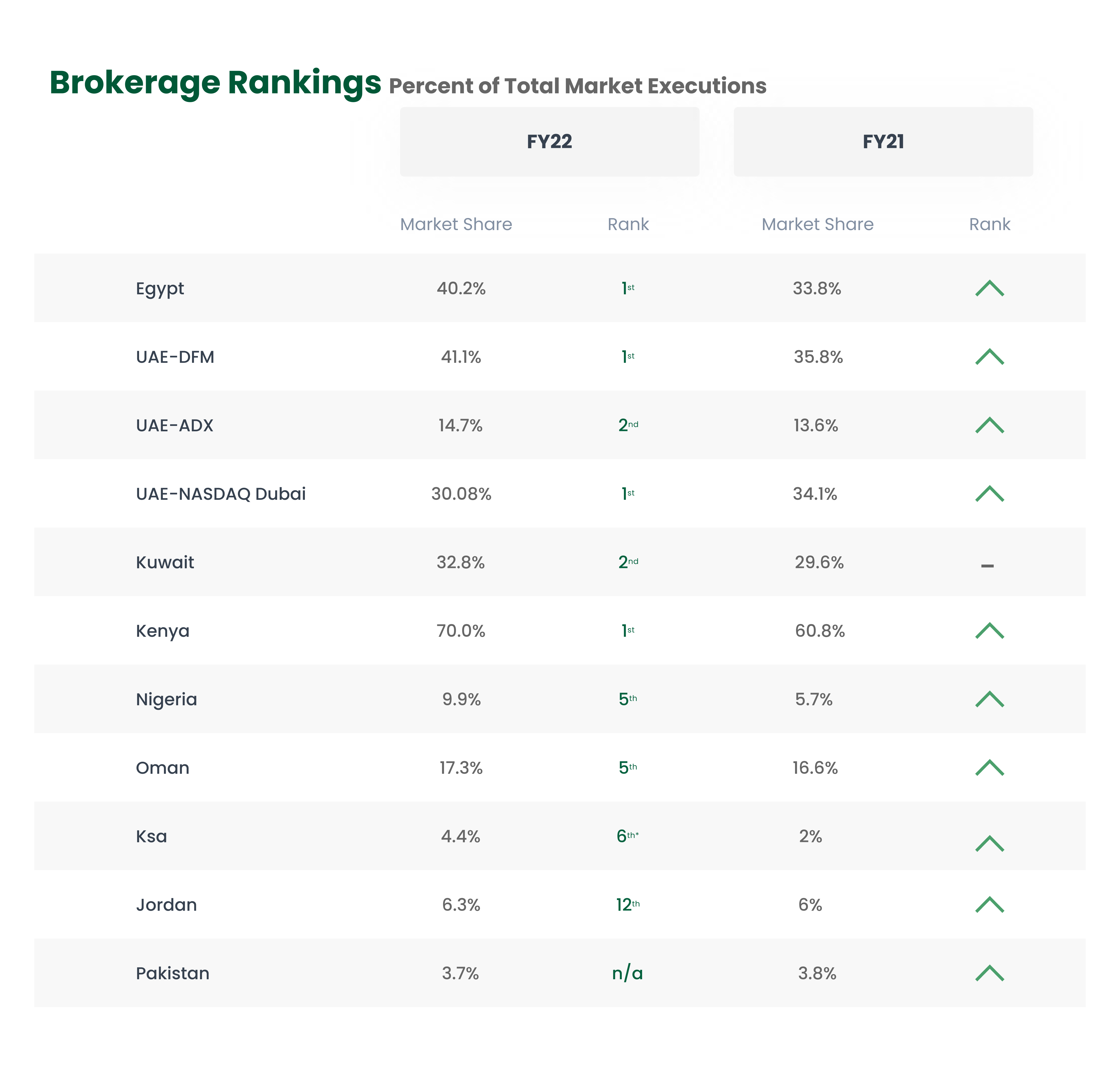

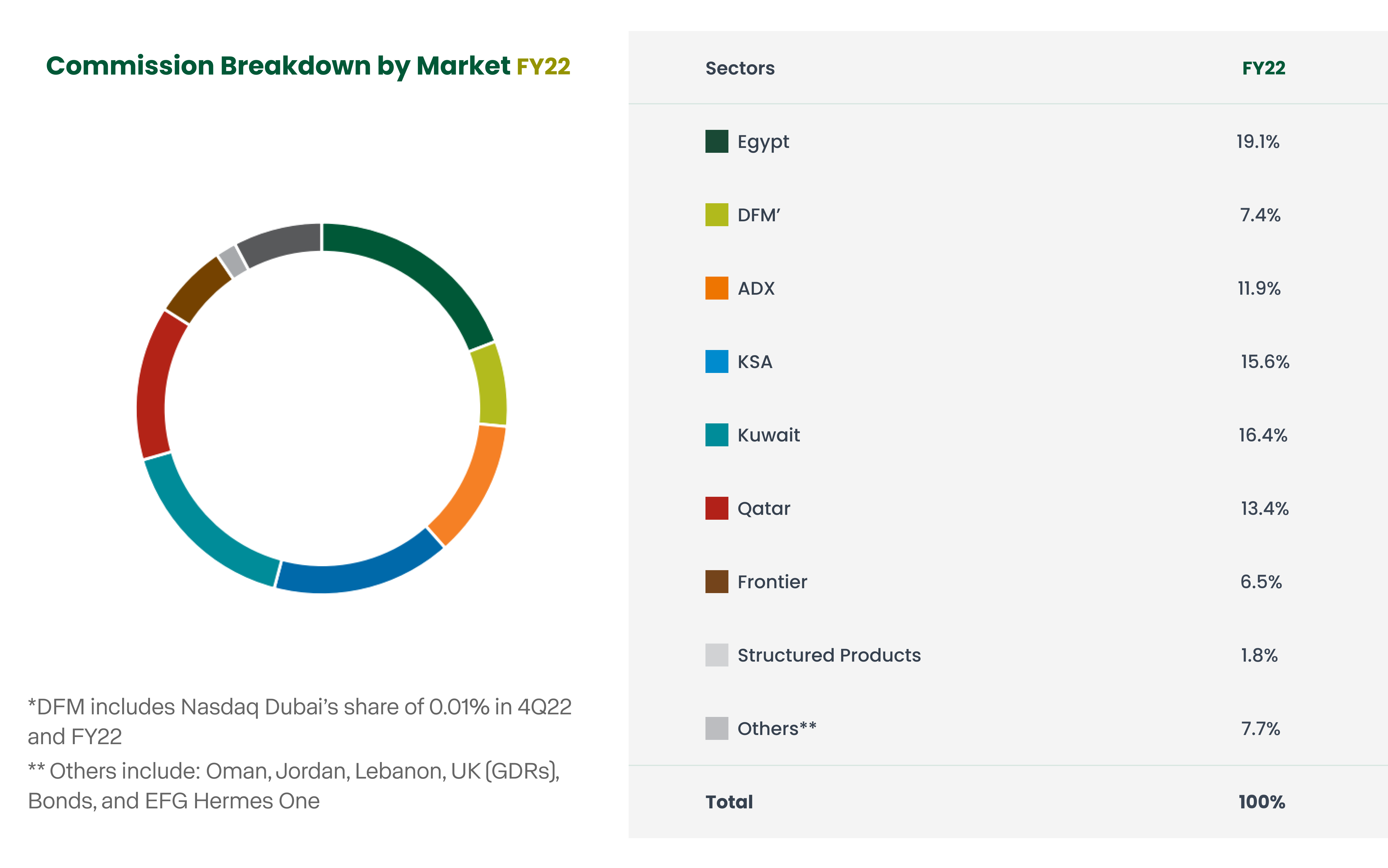

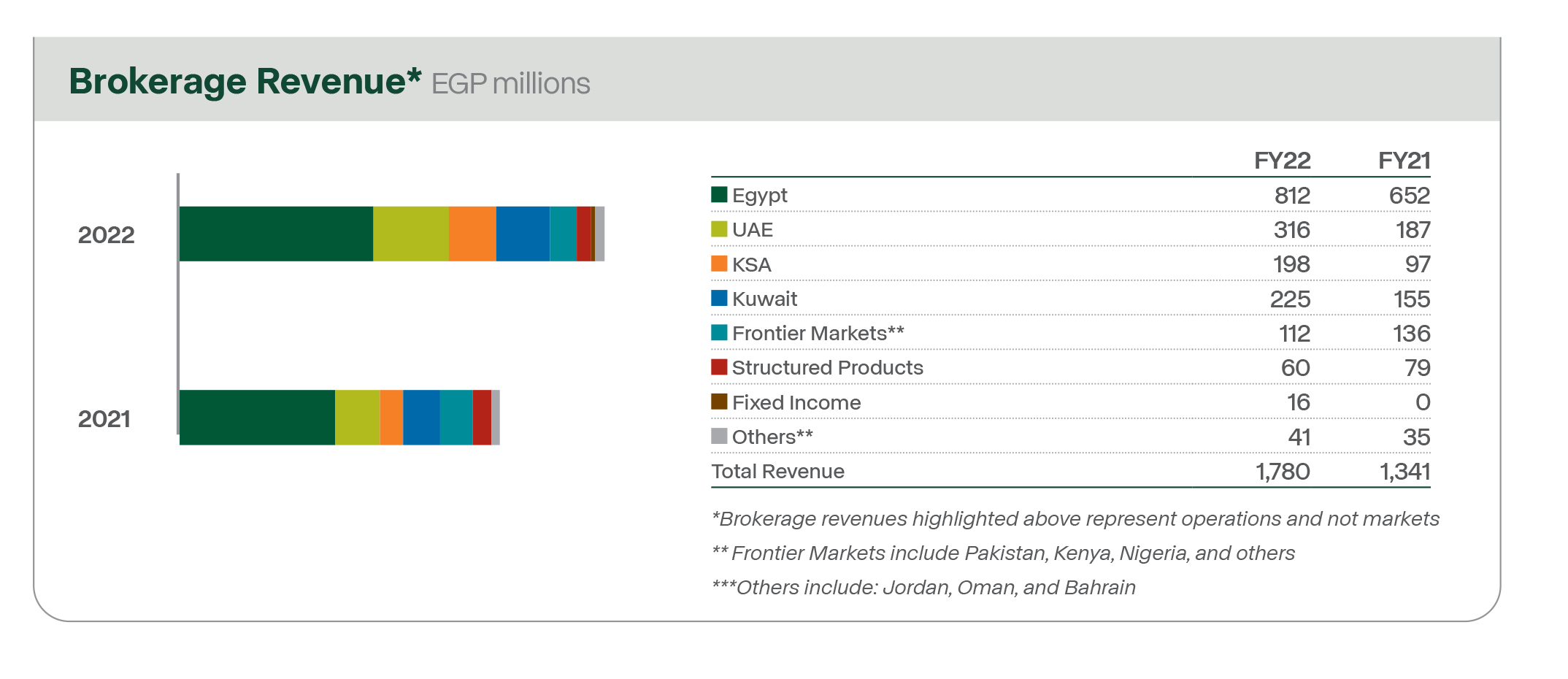

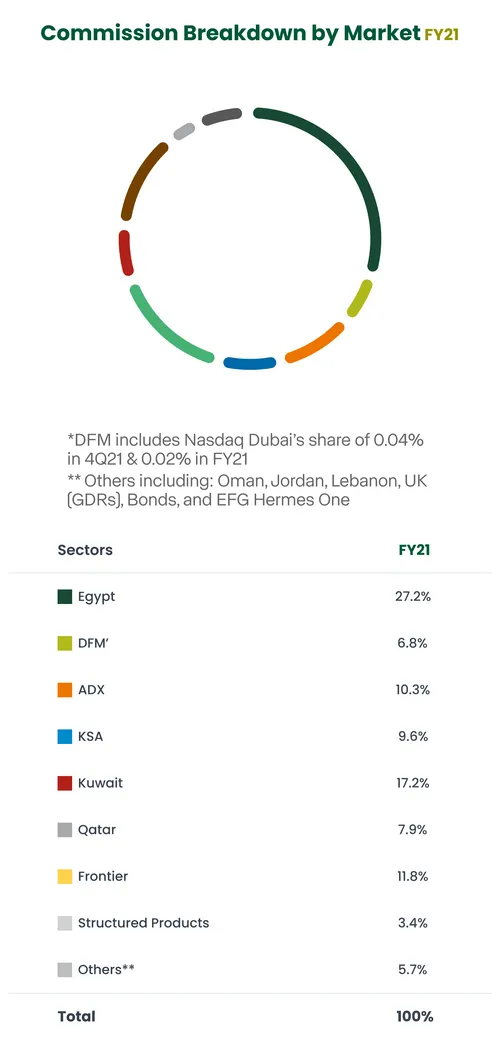

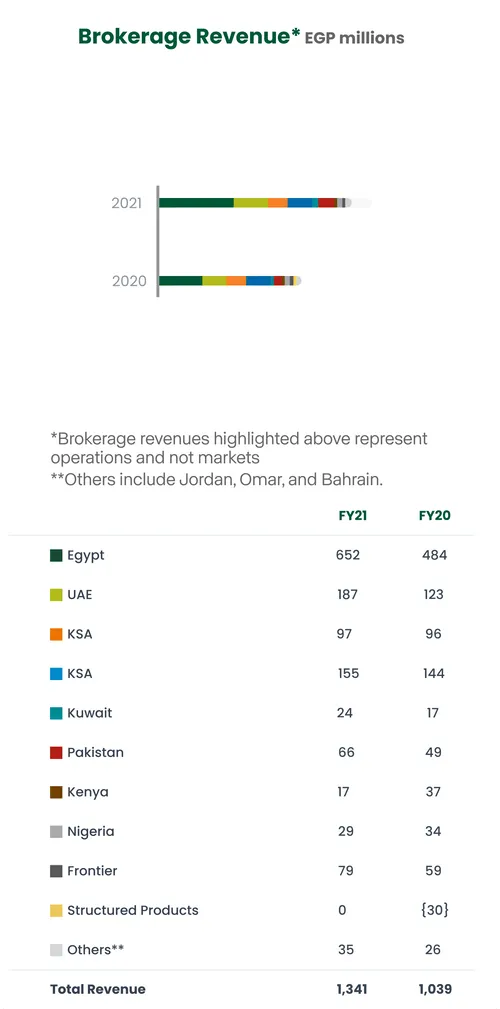

Our premier Brokerage franchise witnessed a record-breaking year, substantially capitalizing on the volatility in the MENA region’s markets to increase traded volumes and market shares, particularly in the GCC region. By year-end 2022, the division successfully sustained its rankings across most of its focus markets, ranking first on the EGX and the DFM and second in Abu Dhabi and Kuwait. Leveraging the region's highly volatile trading environment, we successfully attracted a more extensive client base across our online trading platform, EFG Hermes One, and unlocked a larger number of MENA-focused prospects for our investors. In the frontier markets in which we operate, our Brokerage division delivered a commendable performance despite the region's lingering macroeconomic and political challenges. The division was the highest ranked in Kenya for the third consecutive year and continued to strengthen its position in Pakistan and Nigeria.

Another landmark milestone we take pride in is the first in-person iteration of our flagship One on One Conference following the onset of the COVID-19 pandemic, which took place in September 2022. The conference facilitated thousands of meetings, bringing together hundreds of regional and global investors seeking the region's most value-accretive investment opportunities. We were incredibly proud of the success of this iteration.

On the investment banking side, our flagship Investment Banking division performed remarkably during 2022, leveraging its unrivaled execution capabilities to advise on the most prominent ECM, DCM, and M&A deals across the region. The highlight for 2022 — and something we are incredibly proud of — was our ability to capitalize on the significant boom in ECM activity in the GCC, which has rapidly grown to become an investment haven for regional and global investors alike. Our Investment Banking division has undoubtedly played a pivotal role in making these offerings happen and bringing a wider range of high-value investment prospects to market. The division facilitated a total of 12 ECM transactions in 2022, 10 of which were IPOs, including the USD 6.1 billion listing of Dubai utility player DEWA, the USD 724 million initial public offering of Empower on the Dubai Financial Market (DFM), and the USD 1.0 billion listing of Dubai’s exclusive toll-gate operator Salik on the DFM. Another landmark transaction the division advised on was the USD 1.8 billion dual-listing of restaurant-chain operator Americana on the ADX and the Saudi Exchange — a never-before-seen listing between both exchanges — and the USD 378 million IPO of Riyadh Cables Group (RCGC) — the largest cable manufacturer in the region — during the year. The division also advised on education provider Taaleem’s USD 204 million IPO on the DFM, the USD 2.0 billion listing of Borouge on the Abu Dhabi Exchange (ADX), and Ali Alghanim and Sons Automotive Company’s USD 323 million private placement ahead of its IPO on Boursa Kuwait — the first international IPO on the Kuwaiti exchange since 2020. In Oman, the division advised on the USD 60.6 million IPO of Pearl REIF — Oman’s largest Shariah-compliant real estate investment fund — on the Muscat Stock Exchange (MSX).

On the M&A front, EFG Hermes Investment Banking acted as sell-side advisor on the acquisition of a 70% stake in two Egypt-based maritime and terminal operating companies, Transmar International Shipping Company (Transmar) and Transcargo International (TCI), by Abu Dhabi Ports Group (AD Ports). The transaction, valued at USD 140 million, marked AD Ports’ first investment in Egypt. The team also acted as buy-side advisor to the Public Investment Fund of Saudi Arabia (PIF) on its indirect acquisition of a significant minority stake in B.Tech, Egypt’s leading consumer electronics retailer. Other landmark deals for the year included the sell-side advisory on the USD 115.7 million majority acquisition of Auf Group, a leading healthy snacks and coffee manufacturer as well as retailer in Egypt, by UAE-based Agthia, a leading food and beverage company in the region.

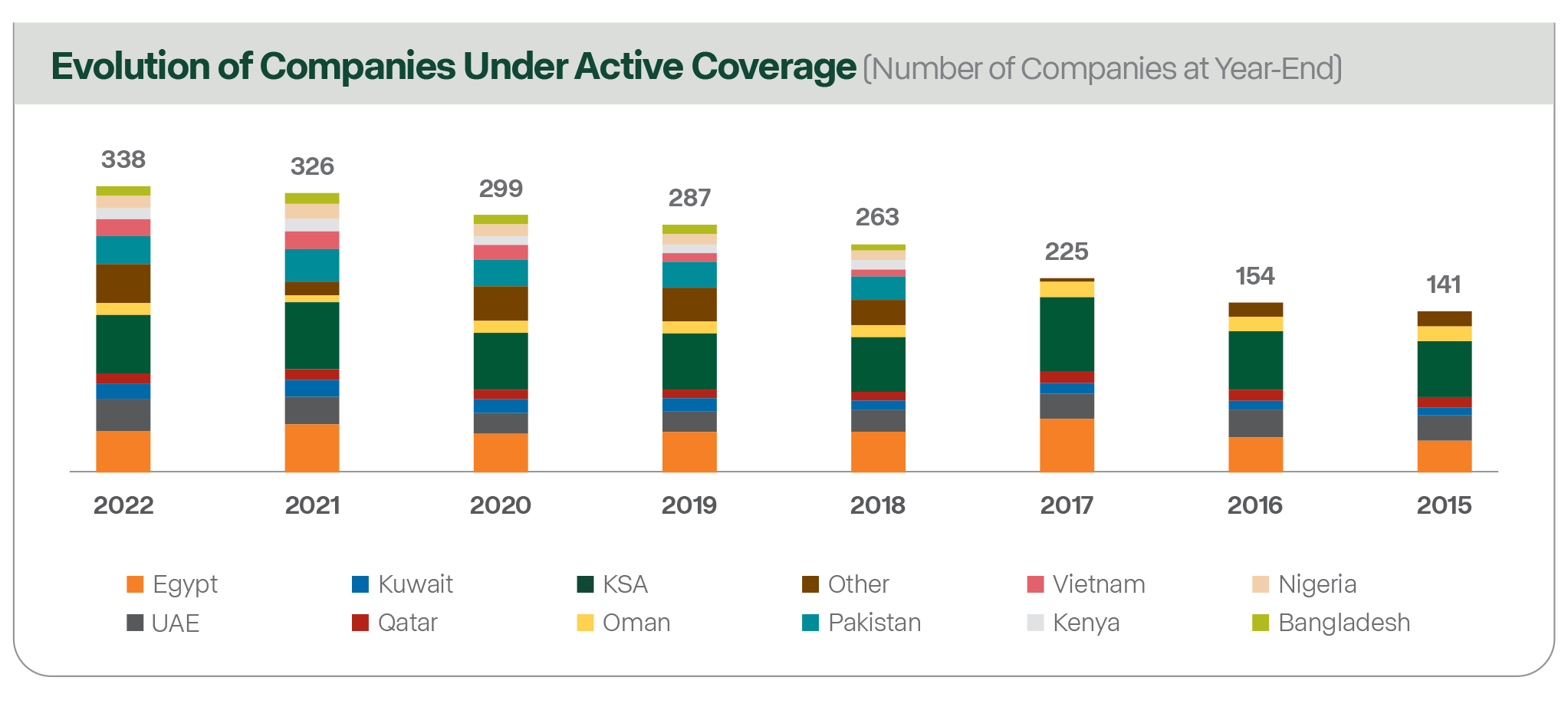

Alongside the success of our Brokerage and Investment Banking divisions, our Research division was once again recognized as the chief regional provider of fundamental- based research, facilitating well-rounded products, tools, and insights for our teams and clientele across the board. During the year, the division expanded coverage to 348 stocks, focusing on expanding its presence in Southeast Asia as part and parcel of our strategy to broaden our research coverage regionally. Additionally, the division supported the Firm’s Investment Banking division in advising on the region’s largest IPOs — all of which were closed with the help of the Research division’s unrivaled insights.

Despite the world witnessing consequential incidents, our goals for next year stay the same — to continue building on the tremendous success we have worked so tenaciously to achieve over the last four decades. On the investment banking front, we will continue to capitalize on the ever-growing demand in the markets where we operate by offering the most compelling ECM, DCM, and M&A propositions. The GCC has proven to be a market to watch, and the significant ramp-up in ECM activity over the last year is something we aim to propel going forward. In our home market of Egypt, we continue to see growing demand for DCM products. We aim to capitalize on this by bringing to market alternative financing solutions that enable our clients to deliver on their expansion plans. Our efforts in Egypt in 2022 also paid off on the M&A front. Having closed several cross-border deals, we plan to continue building on this by connecting global capital to local opportunities that position Egypt as a value-accretive investment destination.

On the brokerage front, and in efforts to ramp up the business from a fintech perspective, we are looking to bring our online, award-winning, and cutting-edge trading platform, EFG Hermes One, to more GCC markets, expanding our online presence and facilitating online trading in the region. On the research front, the division seeks to branch out from its current coverage portfolio and continue focusing on more attractive Southeast Asian markets, such as Indonesia, Thailand, and the Philippines. It also aims to broaden its product offerings to ensure more diversified insights for EFG Hermes Holding and its clients.

As we dive into 2023, we remain confident in our ability to continue building on our track record of remarkable achievements over the years. We are excited to see what the year holds for us in the sell-side business as we remain committed to our clients, partners, and the markets in which we operate. This commitment we so fiercely honor enables us to continue delivering exceptional performance across all metrics, year on year.

Securities Brokerage

Overview

EFG Hermes' Securities Brokerage division is the MENA region’s leading brokerage house offering a wide range of innovative and tailored products and services, secure multi- platform trading tools, market intelligence and insights, and unparalleled executional capabilities, ensuring maximum generated returns tailored to different investor preferences and risk profiles. The division boasts an expansive four- continent presence across the MENA region and FEM and operates in countries that include Egypt, Kuwait, the UAE, Saudi Arabia, Oman, Jordan, Pakistan, Kenya, Nigeria, and Bangladesh, with regional offices in the US and the UK.

Online Trading

Investment Banking

Overview

EFG Hermes' Investment Banking division has grown over the years to become the region’s most trusted advisory house and has successfully cemented its leading position as the regional Investment Banking franchise of choice for partners and clients in the MENA region and FEM. Leveraging decades of industry and market acumen, the division continues to advise on the region’s largest, most prominent transactions in the Mergers and Acquisitions (M&A), Equity Capital Markets (ECM), and Debt Capital Markets (DCM) spaces by leveraging the multidisciplinary experience of over 40 professionals. It provides its clients with key economic, industry, market, and company-focused insights, steering the region with its solid on-the-ground presence and expansive track record. By the end of 2022, the division recorded a total of 32 ECM, DCM, and M&A transactions across its footprint, with an aggregate value of over USD14.3 billion.

Operational Highlights of 2022

In light of the Russia-Ukraine conflict, rising inflationary pressures, currency devaluations, and a high interest-rate environment, 2022 was a challenging year for global markets. Nonetheless, the GCC region came out strong, driven by a solid crude oil market and government initiatives that bolstered capital markets and investor sentiment. In 2022, ECM activity in the GCC boomed, with the UAE, Saudi Arabia, Kuwait, and Oman collectively seeing a record-high number of mega-hit IPOs.

EFG Hermes’ Investment Banking division concluded the year having captured a large share of the most significant transactions in the GCC region. The division closed 13 DCM transactions valued at USD 453 million, 12 ECM transactions valued at USD 12.8 billion, and seven M&A transactions worth USD 1.1 billion. As a result of its strong performance in the equity capital market space, the division placed second on the Refinitiv ECM 2022 League Table.

ECM

In Dubai, the division advised on leading education provider Taaleem’s USD 204 million IPO on the DFM, marking the first private-sector IPO on the DFM since 2014. The transaction also saw EFG Hermes' Investment Banking transition from its typical joint bookrunner role to acting as a joint global coordinator on the listing. The division also concluded advisory on state-owned Dubai Electricity and Water Authority’s (DEWA) USD 6.1 billion IPO on the DFM — the largest ever listing in the Middle East since Saudi Aramco’s IPO in 2019 and the first for a public company in Dubai. The division also advised on the USD 1.0 billion IPO of Dubai toll operator Salik and acted as joint bookrunner on the USD 724 million IPO of Emirates Central Cooling Systems Corporation (Empower). In Abu Dhabi, the division successfully completed advisory on the USD 2.0 billion IPO for leading global petrochemicals manufacturer Borouge plc — a joint venture between Abu Dhabi National Oil Company (ADNOC) and Borealis AG — on the ADX, marking the largest listing in the history of the exchange.

Breaking ground in Kuwait, EFG Hermes completed advisory on the USD 323 million private placement for Ali Alghanim and Sons Automotive Company ahead of its IPO on Boursa Kuwait, for which the division acted as joint bookrunner. Marking the first IPO in the Kuwaiti stock market since 2020 and the largest in the country, the transaction sparked a substantial surge in future IPO activity in Kuwait.

2022 also saw the division act as joint bookrunner on the landmark USD 1.8 billion IPO of Americana Restaurants International Plc (Americana) on the Saudi Stock Exchange and the ADX, marking the first-of-its-kind concurrent dual listing between the two exchanges. Also on the Saudi Exchange, the division advised on the USD 378 million IPO for Riyadh Cables Group (RCGC) — the largest cable manufacturer in the region — during the year.

In Oman, the division advised on the USD 60.6 million IPO of Pearl REIF — Oman’s largest Shariah-compliant real estate investment fund — on the Muscat Stock Exchange (MSX).

In its home market, EFG Hermes acted as sole global coordinator and joint bookrunner on the USD 81.7 million IPO of Macro Group, one of the most prominent cosmeceutical players in the Egyptian market, on the Egyptian Exchange (EGX).

2022 ECM Deals

Macro Group IPO – Joint bookrunner and sole global coordinator on the USD 81.7 million initial public offering on the EGX.

DEWA IPO – Joint bookrunner on the USD 6.1 billion initial public offering on the DFM.

Salik IPO – Joint bookrunner on the USD 1.0 billion initial public offering on the DFM.

Taaleem IPO – Joint global coordinator on the USD 204 million initial public offering on the DFM.

Empower IPO – Joint bookrunner on the USD 724 million initial public offering on the DFM.

Borouge plc IPO – Joint bookrunner on the USD 2.0 billion initial public offering on the ADX.

Riyadh Cables IPO – Joint bookrunner on the USD 378 million initial public offering on the Saudi Exchange.

Americana Dual Listing – Joint bookrunner and underwriter on the USD 1.8 billion dual listing on the ADX and Saudi Exchange.

Ali Alghanim and Sons Automotive Company IPO – Joint bookrunner on the USD 323 million initial public offering on Boursa Kuwait.

Pearl REIF IPO – Joint bookrunner on the USD 60.6 million initial public offering on the MSX.

Fawry Rights Issue – Sole financial advisor on the USD 43.2 million rights issue on the EGX.

M&A

On the M&A front, the Firm’s Investment Banking team delivered a solid performance during 2022, bridging the gap between its home market of Egypt and the GCC. The division acted as sell-side advisor on the USD 500 million majority stake sale of Al Meswak Dental Clinics, the largest dental and dermatology service provider in Saudi Arabia.

In Egypt, EFG Hermes’ Investment Banking division acted as a sell-side advisor on the acquisition of a 70% stake in two Egypt-based maritime and terminal operating companies, Transmar International Shipping Company (Transmar) and Transcargo International (TCI), by Abu Dhabi Ports Group (AD Ports). The transaction, valued at USD 140 million, marked AD Ports’ first investment in Egypt.

The team also acted as a buy-side advisor to the Public In- vestment Fund of Saudi Arabia (PIF) on its indirect acquisition of a significant minority stake in B.Tech, Egypt’s leading consumer electronics retailer.

Other landmark deals for the year included the sell-side advisory on the USD 115.7 million majority acquisition of Auf Group, a leading healthy snacks and coffee manufacturer as well as retailer in Egypt, by UAE-based Agthia, a leading food and beverage company in the region.

2022 M&A Deals

Transmar International Shipping Company and Transcargo International (TCI) Sale – Sell-side financial advisor to Transmar and TCI’s shareholders on the 70% stake sale of both companies to AD Ports in a transaction worth USD 140 million.

Auf Group Sale – Sell-side financial advisor to Auf Group on the majority stake sale to UAE-based Agthia worth USD 115.7 million.

Credit Agricole S.A. Accelerated Direct Purchase – Buy- side advisor to Credit Agricole S.A. on its direct purchase of a 4.8% stake in Credit Agricole Egypt in a transaction worth USD 21.1 million.

B.Tech Acquisition – Buy-side advisor to the PIF on its indirect acquisition of a significant minority stake in B.Tech.

Al Meswak Dental Clinics Sale – Sell-side advisor on the USD 500.0 million majority stake sale of Al Meswak Dental Clinics to Jadwa.

DCM

In the DCM space, the Firm’s Investment Banking division recorded a solid performance during the year. It continued to provide alternative financing solutions to the market while supporting its clients in delivering on their expansion plans. Milestone DCM transactions for the year included the team’s advisory on several securitization deals for the Firm’s subsidiaries, including EFG Hermes Corp-Solutions’ second issuance in its securitization program, in a transaction worth USD 102.3 million, marking the team’s largest debt transaction in 2022. Another synergistic transaction was that of Bedaya Mortgage Finance, which saw the division advise on the mortgage finance player’s first securitization issuance worth USD 35.2 million.

To further solidify its position as the partner of choice in the ever-growing Egyptian real estate industry, the team ad- vised chief real estate player Orascom Development Egypt on the USD 81.1 million financing package for its flagship O-West project.

Parallel to this, the team advised MARAKEZ, a leading Saudi real estate player in Egypt, on its USD 39.2 mil- lion debt arrangement alongside EFG Hermes Corp-Solutions and the Firm’s recently acquired aiBANK, who acted as leasing partner and lender, respectively — a testament to the division’s unrivaled ability to provide end-to-end financial solutions to its clients by capitalizing on the synergies between the Firm’s wide-ranging lines of business.

As part and parcel of its strategy to bring a broader range of offerings to market, the Investment Banking division concluded advisory on CIRA Education’s USD 32.7 million future flow securitization bond offering — Egypt’s first ever future flow securitization issuance.

2022 DCM Deals

Pioneers Properties Securitization Program – Financial advisor, lead arranger, underwriter, and bookrunner on Pioneers Properties’ second and third securitization bond issuance worth USD 23.0 million and USD 11.9 million, respectively.

EFG Hermes Corp-Solutions Securitization Program – Advised EFG Hermes Corp-Solutions on its second securitization issuance in a transaction worth USD 102.3 billion.

EFG Hermes Corp-Solutions Bond Offering – Advised on the USD 27.0 million bond issuance for EFG Hermes Corp- Solutions.

valU Securitization Program – Advised valU on the second issuance of its securitization program in a transaction worth USD 27.5 million.

MARAKEZ Debt Arrangement – Advised MARAKEZ on its USD 39.2 million debt arrangement.

Orascom Development Financing Package – Advised leading real estate player Orascom Development Egypt on the USD 81.1 million financing package for its flagship O-West project.

Bedaya Securitization Program – Sole financial advisor on the USD 35.2 million securitization issuance for Bedaya Mortgage Finance, the first securitization issuance for a real estate mortgage company in Egypt.

Orascom Development Financing Package – Advised leading real estate player Orascom Development Egypt on the USD 81.1 million financing package for its flagship O-West project.

Madinet Nasr for Housing and Development (MNHD) Securitization Program – Sole financial advisor on the USD 19.1 million securitization issuance for MNHD. Premium International for Credit Services (Premium) Securitization Program – Advised Premium on the sixth and seventh issuances of its short-term securitization program, worth USD 10.8 million and USD 8.1 million, respectively.

CIRA Future Flow Securitization Program – Advised CIRA on a USD 32.7 million future flow securitization issuance, the first future flow securitization issuance in the Egyptian DCM space.

valU Securitization Program – Advised valU on the third issuance of its securitization program in a transaction worth USD 34.7 million.

Key Financial Highlights of 2022

EFG Hermes’ Investment Banking division reported total revenues of EGP 748 million at year-end 2022, reflecting a 51% increase from the EGP 494 million booked in 2021. Investment banking revenues contributed approximately 7% of EFG Hermes Holding’s total revenue in 2022.

Forward-Looking Strategy

While 2023 is expected to present challenging conditions for global markets, EFG Hermes' Investment Banking division remains confident in its ability to continue expanding its range of offerings and providing more compelling, value-accretive investment prospects across the markets in which it operates. The GCC region remains a global investment hub, particularly on the equity front. In alignment with this, EFG Hermes' Investment Banking division aims to continue leveraging its unparalleled execution and research capabilities to lead and advise and research capabilities to lead and advise on the region’s largest, most notable transactions in efforts to sustain its position as the leading investment banking franchise in the equity landscape. Parallel to launching new products, the division also aims to expand into more rapidly growing sectors across the region. In Egypt, currency devaluations, coupled with the state’s privatization and reform program, are slated to

drive a surge in foreign investment inflows and bolster activity across the country’s capital markets, particularly on the M&A side. Shedding light on debt capital markets, the division aims to continue capitalizing on the high demand present both in Egypt and the broader region by infusing the market with a comprehensive set of both conventional debt products and innovative funding solutions that are not only tailored to changing market dynamics but also unlock the most potent growth prospects for the division and the Firm as a whole.

Research

Overview

EFG Hermes’ Research division is the region’s premier provider of in-depth, real-time market insights with macro, strategy, sector, and equity expertise provided by award-winning analysts. With 348 stocks under coverage in 40 sectors across 26 markets, the division sets the industry standard for delivering the most comprehensive and impactful FEM research to clients around the world.

With on-the-ground insights from analysts based across the Firm’s footprint, the division’s ability to provide differentiated research products that identify opportunities and allow clients to make informed investment decisions is unmatched. This has proved invaluable in 2022 considering the unprecedented geopolitical, as well as macroeconomic, turbulences that have threatened the stability of FEM and, in turn, impacted capital flowing into those markets from institutional and retail clients alike.

The division’s growing ability to constantly expand its coverage universe and tailor its product offering to the evolving needs of its clients has cemented its position in recent years as the research house of choice for equity and strategy research in FEM.

The buy-side business delivered solid results this year, capitalizing on the growing demand for compelling and value-generating investment prospects, all while contributing to the Group’s consolidated revenue growth

.png)

Buy-Side Overview

Despite the year's market conditions on the back of geopolitical tensions that had knock-on effects on energy and commodity prices, the shrinking value of currencies in most emerging markets, and monetary tightening raising the alarm bells of recession, EFG Hermes continued to demonstrate resilience across its core operations. The strategies we set out in previous years shielded us from headwinds in 2022, as we worked to continue bringing to market varied, innovative financial offerings that allowed us to surpass regional benchmarks and peer averages. The buy-side business, in particular, delivered solid results this year, capitalizing on the growing demand for compelling and value-generating investment prospects, all while contributing to the Group’s consolidated revenue growth.

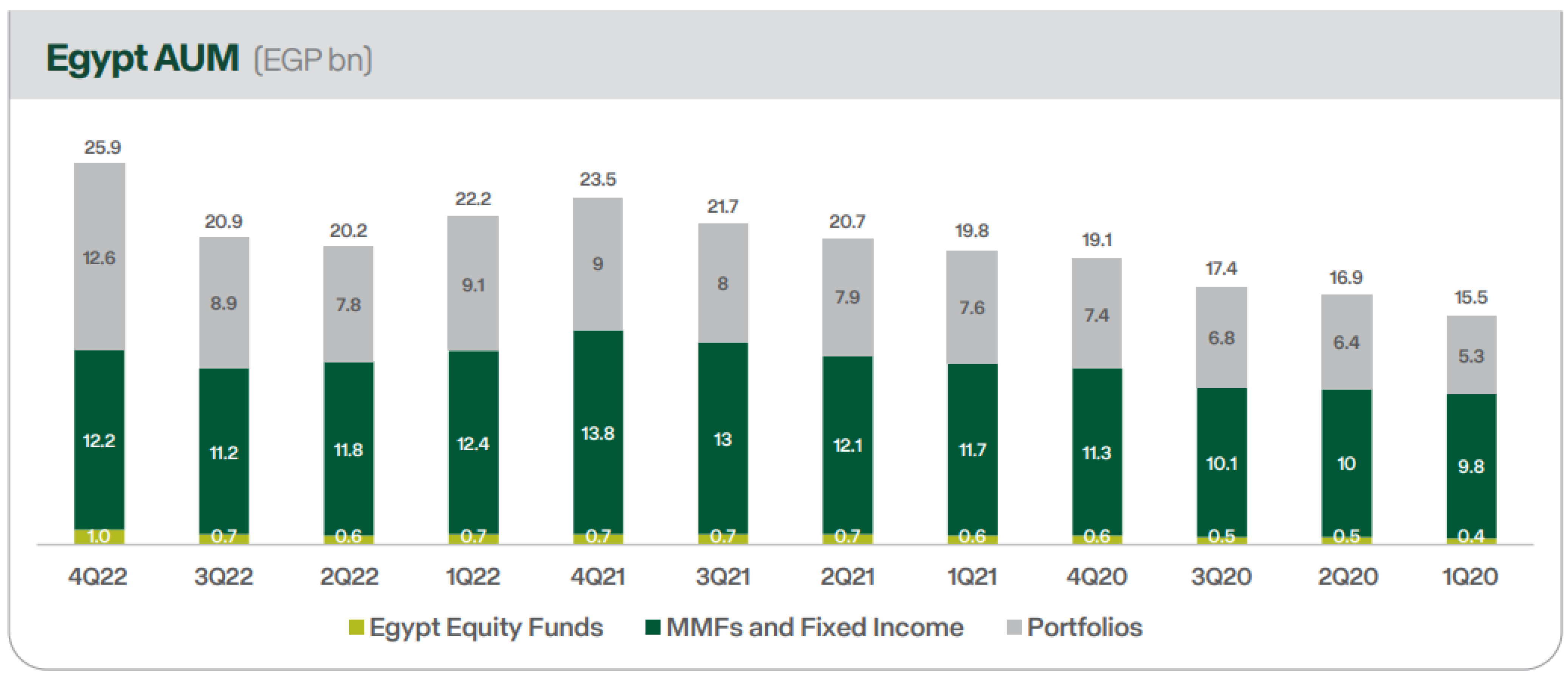

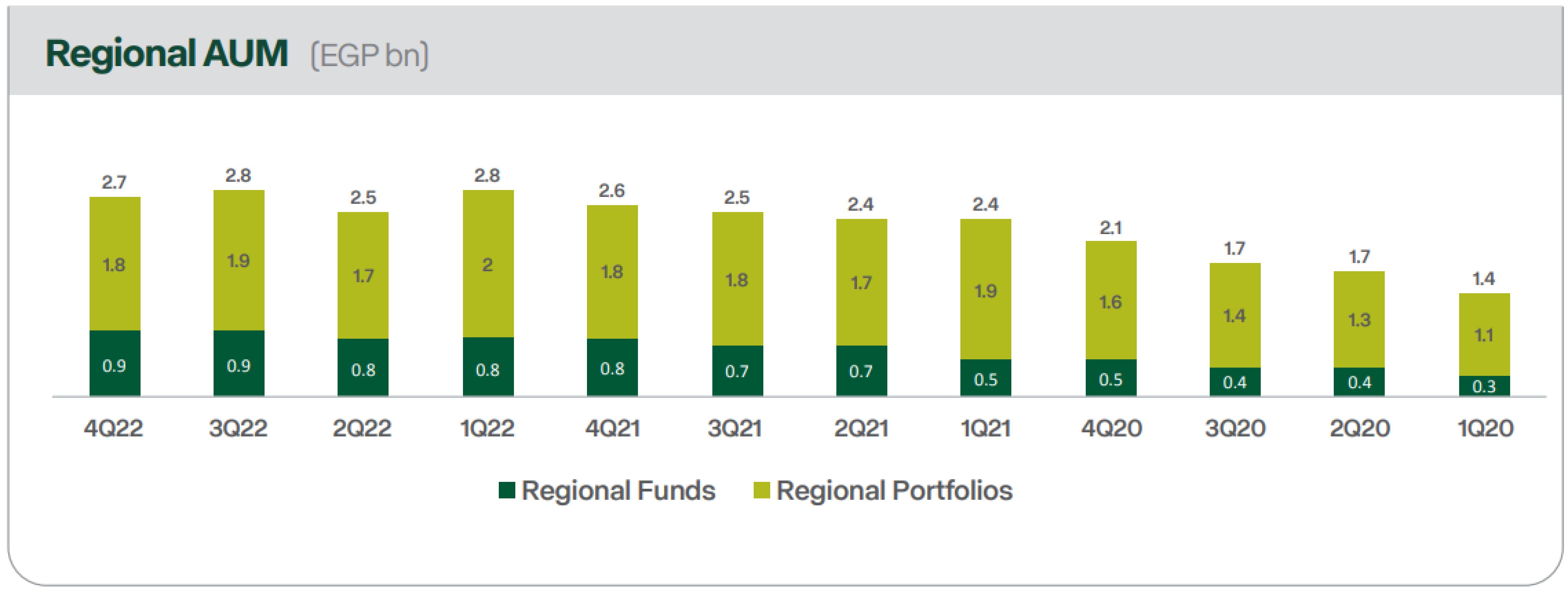

On the asset management side of the house, EFG Hermes’ Asset Management division recorded revenues of EGP 553 million in 2022, up 5% Y-o-Y from the EGP 528 million recorded at year-end 2021. Local and regional assets under management (AUM) both registered a solid increase during the year, with Egypt AUM growing 10% to record EGP 25.9 billion and regional AUM increasing 5.2% to stand at USD 2.7 billion. I am also happy to announce that the division was successful in further extending its regional presence this year, having established a new dedicated office in Muscat, Oman.

On the private equity side, the division’s flagship energy transition platform, Vortex Energy, continued to build on its strategic and fruitful partnership with Spain-based Ignis Energy Holdings, which facilitated a multitude of opportunities for the platform to continue growing its investment portfolio and broadening its outreach across various European countries. During the year, and through its recently launched fund Vortex Energy IV, Vortex Energy, along with its co-investors, injected the second tranche of its investment in Ignis Energy Holdings, worth c. EUR 228 million. Our partnership with such a globally renowned player not only enables us to cater to the growing demand present in the sustainable and responsible investing space but also to continue playing a fundamental role in contributing to the global transition toward a net-zero emissions future.

Alongside our success in the renewable energy space, 2022 was a solid year for our healthcare platform Rx Healthcare Management (RxHM), which continued to grow its operations in collaboration with leading medical solutions provider, United Pharma. I am delighted to say that we were successful in enhancing our production capacities and expanding our geographical footprint during the year, in line with our strategy to provide a better-rounded roster of innovative healthcare solutions across the region.

In the education sector, the year saw our full-fledged education-focused platform, the Egypt Education Fund (EEF), broaden its capacities in Egypt’s ever-growing education space by adding more prominent international schools to its portfolio. Leveraging its acquisition of Al Hayah International Academy back in 2021, the platform acquired Hayah West in Sheikh Zayed. Additionally, the EEF was successful in acquiring GEMS International School in Cairo (GISC) and Trillium the Montessori house, marking our strategic entry into the nascent pre-K segment. Branching out of Egypt’s capital, the EEF entered into an agreement with Abu Soma Development to establish a school in Soma Bay, which is set to kick off operations in 2024.

As a result of the solid performance delivered across all three platforms, the division closed the year with revenues of EGP 171 million, reflecting an increase of 57% Y-o-Y from the EGP 109 million booked in 2021.

Although the macroeconomic challenges we faced this year are expected to linger in 2023, I amconfident that both our Private Equity and Asset Management arms will continue to uphold their commitment to our stakeholders and will remain dedicated to building on the tremendous success achieved over the years. It is of utmost importance for us to continue sustaining our strong position in the regional markets in which we operate, and we aim to continue charging the market with investment prospects and innovative offerings that not only generate returns for our clients and bolster the Firm’s financial position but also create long-term, meaningful value on a regional scale.

Asset Management

Overview

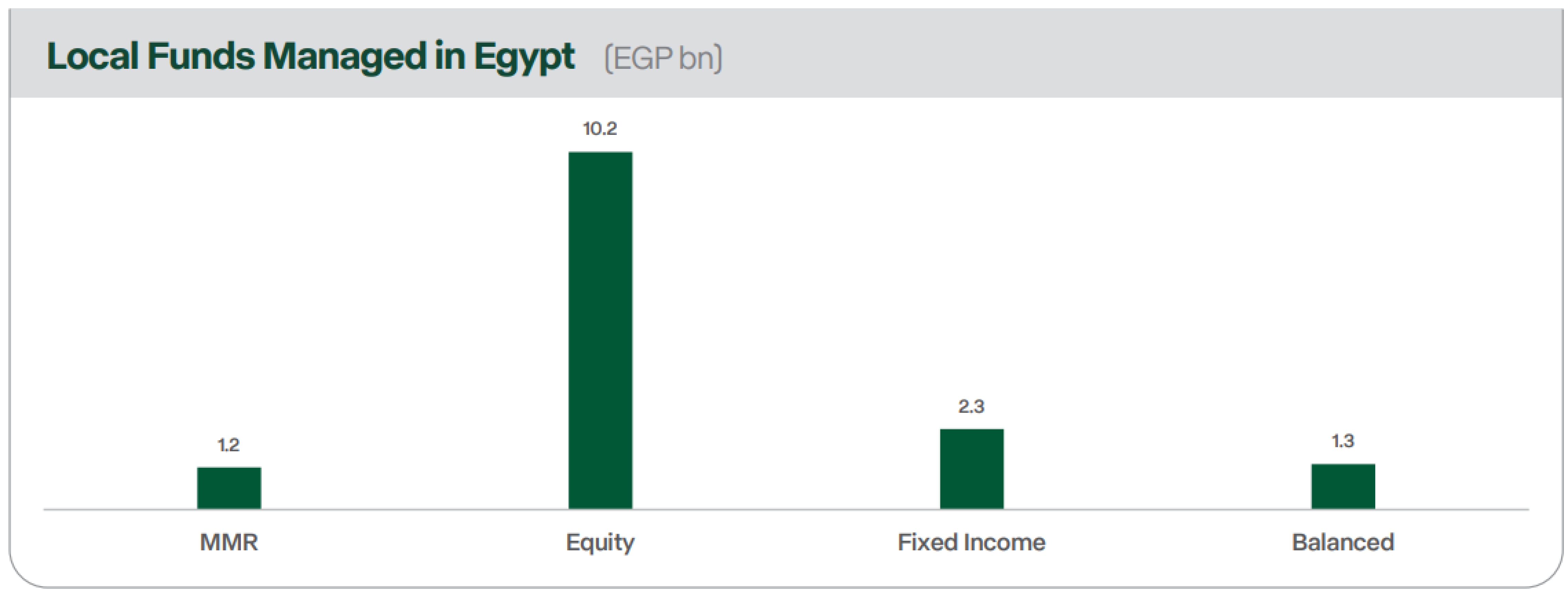

EFG Hermes’ Asset Management division, the MENA region’s leading asset manager, offers its clients a diverse and comprehensive suite of mutual funds and discretionary portfolios comprising of country-specific and regional mandates, including money market, fixed income, indexed, and Shariah- and UCTIS-compliant mandates. Powered by a team of regional industry experts, EFG Hermes' Asset Management division caters to an ever-growing client base of individual and institutional clients, as well as government-backed entities. The division unlocks value-accretive investment prospects, market insights, and other value-add services that are tailored to different individual preferences, financial objectives, and risk appetites.

Operational Highlights of 2022

Despite the challenges driven by inflationary pressures, higher interest rates, and currency devaluations, the MENA region’s capital markets remained resilient during the year. EFG Hermes’ Asset Management division ended 2022 on a strong note, winning new mandates, outperforming peer averages, and sustaining its leading position as the asset manager of choice across the region.

By the end of 2022, the division’s AUMs in Egypt had hiked by 10% Y-o-Y to record EGP 25.9 billion, up from the EGP 23.5 billion recorded at year-end 2021. The increase was primarily driven by the favorable performance of equity markets during the year, coupled with rising net inflows in money market funds (MMFs).

Despite the challenging market conditions, regional AUMs from the Firm’s regional arm, Frontier Investment Management (FIM) Partners, also grew in 2022 to record USD 2.7 billion, up 5.2% from the USD 2.6 billion booked one year previously, as the division delivered a solid performance across its funds and managed accounts, in addition to the growth in net inflows from equity port- folios. Additionally, FIM was successful in onboarding a new key account during the year, as a cornerstone of its strategy to broaden its investor network.

During the year, and in efforts to expand its regional presence, the Asset Management division successfully established a new office in Muscat, Oman.

Key Financial Highlights of 2022

Asset Management revenues rose by 5% Y-o-Y in 2022 to EGP 553 million, compared to the EGP 528 million reported in 2021, on the back of the higher incentive fees booked by the regional asset management arm, FIM.

Awards

In 2022, EFG Hermes Asset Management was named Best Asset Manager in Egypt and Pan-Africa by EMEA Finance African Banking Awards 2022 and was ranked 18th in Forbes Middle East’s Top 30 Asset Management Companies.

Forward-Looking Strategy

Going into 2023, the Asset Management division aims to continue delivering long-term value to its investors and other stakeholders and cementing its leading position across the regional markets in which it operates. The year ahead will see the division bring to market a wider range of innovative emerging market equity and fixed income products in efforts to complement its suite of existing offerings and to grow its roster of offerings in Egypt and region-wide. Capitalizing on the ever-growing importance of sustainable investing for individual and institutional investors alike, the division’s regional arm, FIM, continues to operate in accordance with the highest ESG investing standards, and it is in the process of enhancing its ESG policies to better serve changing investor dynamics across different asset classes.

Private Equity

Overview

EFG Hermes’ Private Equity platform drives value-accretive investments in sectors that are strategic and impactful by providing rapid and flexible investment capital. The platform’s unmatched capacity building and technical assistance, combined with its strategic leadership management, are some of the factors enabling it to grow its businesses swiftly across its footprint. As a long-term impact investor, the division invests in businesses operating in key industries — including renewable energy, education, and healthcare — that generate not only lucrative financial returns but also social and environmental impacts.

On the renewables front, the division manages investments through its dedicated Europe-focused platform, Vortex Energy. The platform, which was launched in 2014, funds projects in the fast-growing energy transition industry to drive higher sustainable development and lay the foundation for the transition toward clean energy. Today, Vortex Energy is a leading energy transition investment manager that seamlessly executes deal sourcing, structuring, financing, asset integration, and divestment on a global scale.

In the ever-growing education sector, EFG Hermes’ EEF is a USD 150 million investment fund that was launched in 2018. In line with its strategy to carry out socially impactful investments, EEF continues to grow and develop Egypt’s underserved K-12 sector through investments in schools and greenfield developments, in addition to building a vertically integrated platform to manage and enhance operations more effectively.

In the healthcare space, the Firm’s healthcare-focused investment platform, RxHM, was established to manage diverse investments across the healthcare sector to meet the rapidly growing demand for premium healthcare offerings across Egypt, the MENA region, and Africa at large. In 2019, the platform successfully completed the acquisition of a majority stake in United Pharma, a leading Egyptian medical solutions provider, in efforts to expand United Pharma’s medical product offerings across the region.

2022 Operational Highlights

Vortex Energy